Asbestos is a toxic material that is often found in buildings and homes – and it is something that can be fatal if you come into contact with it. Asbestos may consist of the six fibrous materials listed below, as they are all naturally occurring in it. This includes:

- Amosite

- Actinolite

- Chrysotile

- Tremolite

- Crocidolite

- Anthophyllite

The most common types of asbestos are amosite and chrysotile.

As a development finance company, asbestos is a problem that can arise for many clients and in this guide, we explain in further detail what you need to be aware of.

Why Was Asbestos Popular for Construction Purposes?

Prior to the discovery of its toxicity, asbestos was commonly used in construction and on industrial premises as it is highly fire-resistant and durable. We then saw asbestos used across the globe for many everyday homes, building sites, offices and more.

What Was Asbestos Used for?

Given the hardwearing and durable nature of asbestos, it was commonly used as a material for things such as:

- To tile floors

- As a ceiling material

- Roofing shingles

- Put in cement compounds

- Used in textile products

- Vehicle parts

Although asbestos was once a widely used material, is it absolutely not in use any more due to its harm to people.

Why is Asbestos Bad for you?

Asbestos has been linked in to many cancers and also a wide range of respiratory and lung conditions too.

Asbestos was banned from use in the UK in 1999 and it has now been classed as a known human carcinogen.

The use of asbestos declined rapidly from the late 1970s onwards once research and trials were carried out that highlighted how dangerous asbestos could be.

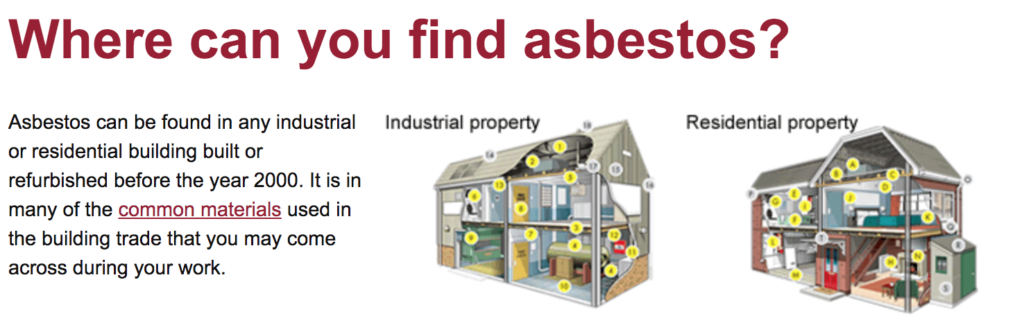

It is still found in buildings and properties built before the year 2000.

What Makes Asbestos Toxic?

One of the main reasons why asbestos is so toxic is because it is so durable.

This is because asbestos fibres are practically microscopic, which means it has the unfortunate side effect of being inhaled very easily.

Inhalation of these fibres are extremely bad for you as they can stay inside your respiratory system, including the lining of your lungs and inner cavity tissue. The fibres can get lodged in the soft internal tissue as they are very small, but rigid in nature.

As it is difficult for the body to expel these fibres and they do not easily break down, inhaled asbestos can be deadly.

How Can Asbestos Be Removed?

Given the toxic properties that asbestos fibres contain, it needs to be handled with great care. If asbestos is located within a building, it should be removed by an asbestos removal contractor. They can assess what will be needed to remove the asbestos, perform asbestos removal as well as carefully dispose of the hazardous material for you.

Can I Remove Asbestos Myself?

It is strongly recommended to not remove asbestos yourself if you have no experience of working with the substance. This is because asbestos becomes most dangerous when it has been disturbed or moved in some way, as its fibres are then released. These fibres can then be inhaled directly into the lungs.

If you do decide to not use an asbestos removal contractor, you should seek advice from your local council and find out how it can be disposed of safely. Keep in mind you may need to get a Health and Safety Executive Licence (HSE) beforehand. This is needed if there strong chance asbestos fibres will be released into the air whilst work is taking place.

Recent Comments